Authored by Christie Hamilton

Since the dawn of finance, wherever there is an object of value, there is a secondary market developed and evolved to provide solutions—namely liquidity—to the asset holders. Private assets, despite the expectation of illiquidity, are no different, and a robust market has developed to match buyers of private interests (typically institutional secondaries funds) with sellers (LPs or GPs, more on this later).

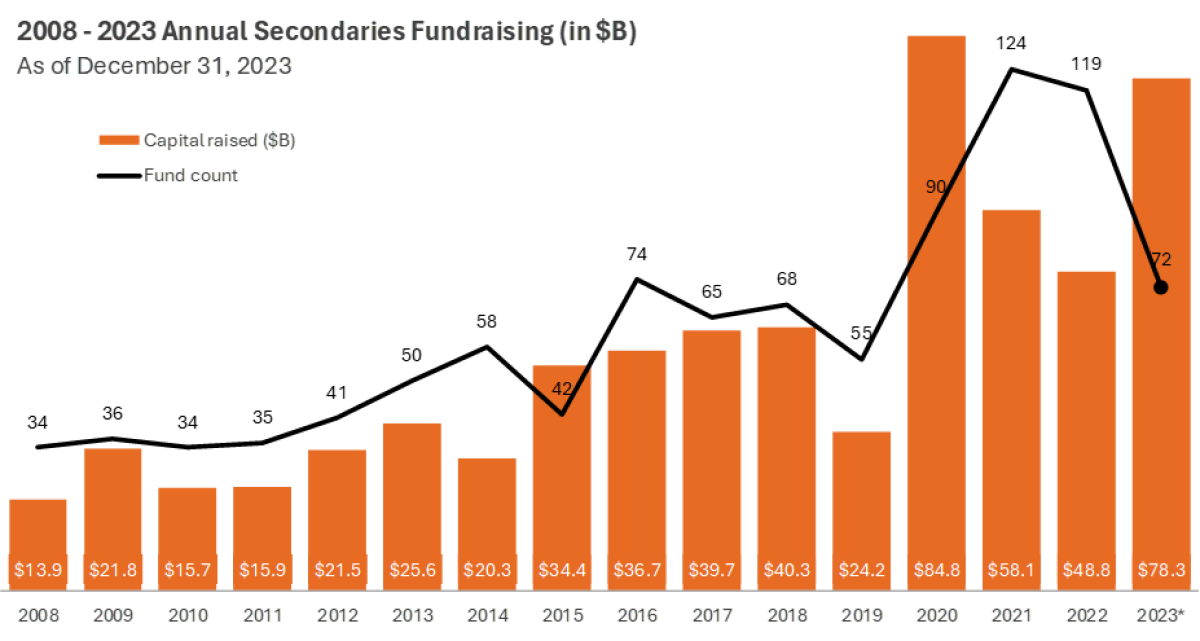

‘Secondaries’ have enjoyed increasing popularity for the last 4 years in particular; however, the strategy’s 40-year history dates to 1984 with VC Fund of America’s initial $6 million fundraise (equivalent to ~$18 million in 2024). Capital raised for secondaries has since ballooned to $73 billion, with over 60% of that committed to four funds according to Pitchbook. Perhaps the more interesting story in the rise of secondaries is how the underlying investment strategies and characteristics have changed considerably in recent years.

Chart: Pitchbook 2023 Annual Global Private Market Fundraising Report excel file.

Cha- Cha- Changes

Initially, secondaries evoked visions of a limited partner quietly in need of liquidity, oftentimes under duress, which was part of the appeal: the LP received cash in exchange for the ‘value’ of its private interest, while the buyer was able to negotiate a meaningful discount on [theoretically] ‘derisked’ assets. As secondaries matured to enable a host of seller needs and attracted new capital, many investors become increasing focused on the “diversifying” effects: mitigating the J-curve and/or boosting portfolio IRR metrics.1

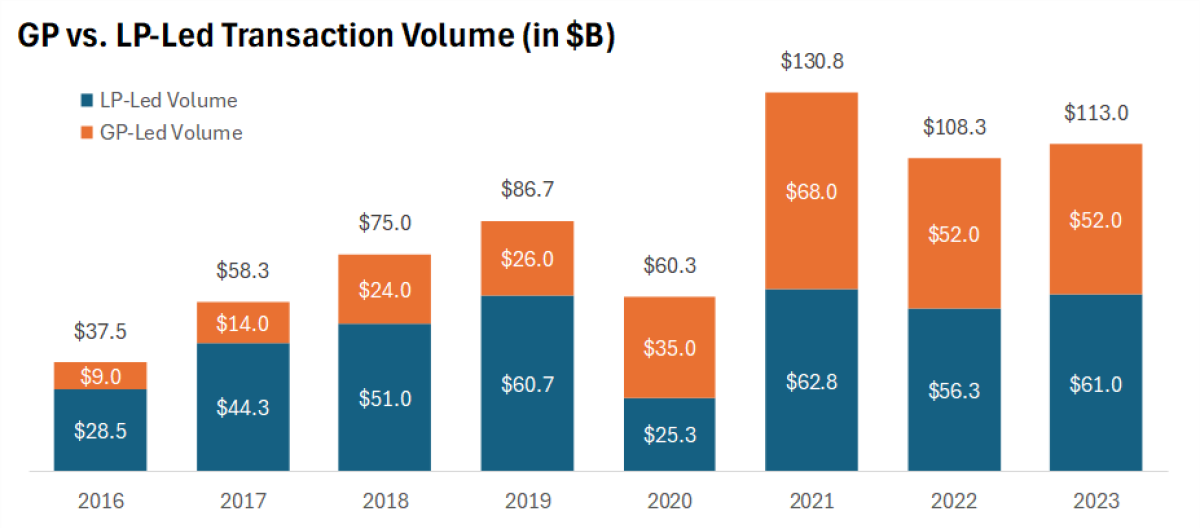

Within the last decade, the market for secondaries has rapidly changed with GPs entering as a meaningful component of seller volume via continuation funds and other unique solutions. This transition has been brought on by a host of factors, particularly as GPs placate LPs frustrated by increasing holding periods and cost of capital considerations brought on by a less than robust exit environment and tighter monetary policy, respectively.

Data: Jefferies Global Secondary Market Review, January 2024.

Secondary Enthusiasm, Secondary Skepticism

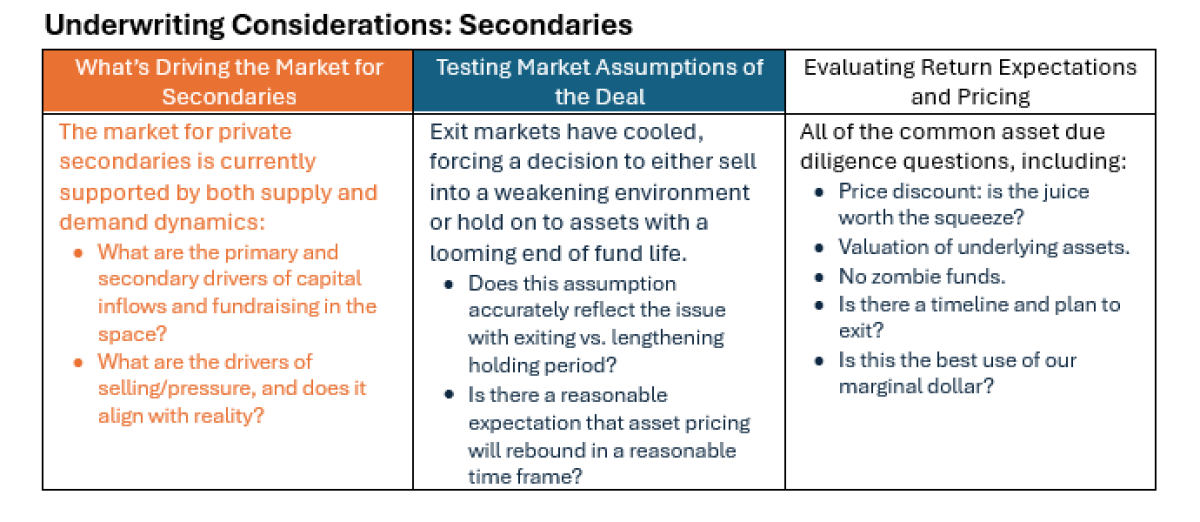

Secondaries can absolutely play an important role in rounding out a diversified private investment portfolio and meet the unique needs of individual investors, but good underwriting requires understanding what’s driving the market, testing assumptions of the deal, and evaluating return expectations for assets that are by their very nature hard to value.

As with all investments, it is not whether the opportunity is good or bad, but whether or not it fits your unique investment and portfolio needs; however, as with any significant transition period, always make sure to invest with your eyes open.

Calendar Reminder. Check back in 3-5 years to see where results are trending.

Bonus Content. If you’re interested in taking a deeper look at the opportunity in secondaries, check out these fantastic resources. Enjoy!

Myths and Reality in GP-Led Secondaries (CAIA Philadelphia Chapter Event)

Jefferies Global Secondary Market Review 2024

The Evolution of the Private Equity Secondaries Market (CAIS Group)

Secondaries in the First Place: A Compelling Access Point in Private Equity (FS Investments)

Private Equity's Secondary Act (Cliffwater)

ILPA GP-Led Secondary Fund Restructurings

Private Equity: Secondaries Anyone? (Franklin Templeton)